THE CALIBER OPPORTUNISTIC GROWTH FUND III LLC

Institutional Investors

MULTI-FAMILY | COMMERCIAL | INDUSTRIAL

The Caliber Opportunistic Growth III Fund LLC leverages the experience gained from Caliber's previous multi-asset developments to provide you with attractive risk-adjusted returns. The fund is purchasing a blend of development and value-add properties so that you can potentially receive distributions early in the fund's life cycle.

The fund seeks to own real estate in multiple markets, using a flexible investment mandate, Caliber is allowed to find opportunities using various real estate investment asset classes.

$250M

MAXIMUM OFFERING

$50K

MINIMUM INVESTMENT

POTENTIAL CALIBER OPPORTUNISTIC GROWTH FUND III LLC INVESTMENT ASSETS

The following listed properties can be subjected to change based upon various internal and

external factors that may affect strategy, decision-making and other business variables.

The Ridge - Retail*

The plan for Caliber’s retail site at the ridge currently consists of 25.6k SF of retail shops in addition to two 3,000 SF drive-through restaurant pads.

*Conceptual Rendering

JOHNSTOWN | COLORADO

North Ridge - Industrial*

Caliber plans to build 98,000 sq ft of Industrial on its North Ridge Property. The industrial area will offer bay sizes between 5,000-10,000 sq ft and will include front parking with rear loading docks and additional yard space for trailer storage as needed.

*Conceptual Rendering

JOHNSTOWN | COLORADO

West Ridge Development - Multi-Use*

West Ridge is 135 acres located directly West of the Ridge Development. The land will be a mixed-use development consisting of Single Family for-rent-lots, Multi-Family, Industrial and Commercial.

*Conceptual Rendering

JOHNSTOWN | COLORADO

Behavioral Health / Medical (projects)*

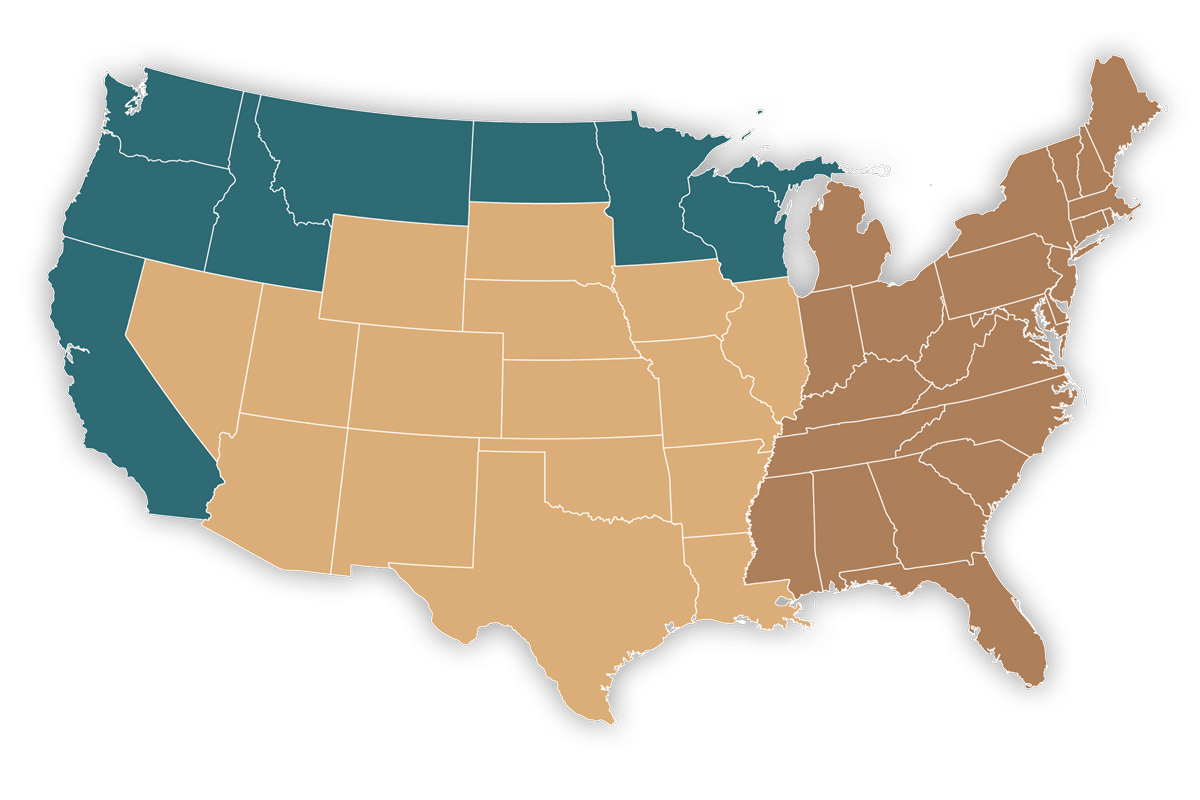

Caliber is partnering with HDP to build approximately 25 Behavioral health locations across the United States. The facilities fill a special need by caring for patients struggling with medical and psychiatric conditions.

*Photo for illustrative purposes only

SOUTHWEST | U.S.

American Resort Communities / Single-Family (projects)*

The partnership for this Joint Venture consists of Caliber-Wealth Development Company and American Resort Communities. Caliber is responsible for capital formation while ARC is tasked with the development and property management of the estimated 30 projects.

*Conceptual Rendering

SOUTHWEST | U.S.

ABOUT THE PROGRAM

INVESTOR Considerations

Below are selected risk factors associated with an investment in the Caliber Opportunistic Growth Fund III LLC.

- Investments in Caliber private placements can lose entire value, are illiquid and are speculative.

- Investment involves high degree of risk; limited liquidity; no public market; suitable only for sophisticated investors;

- Investment strategy is speculative; returns are not guaranteed and no assurance objectives will be achieved;

- May pay distributions and fund redemptions from borrowings, Offering proceeds, or asset sales with no limits on amounts it may pay from such sources;

- May invest in securities that involve a higher degree of risk or have valuations that fluctuate dramatically;

- Access to debt financing may be limited and subject to rate increases, restrictive covenants, or untimely repayment obligations;

- Involves unique risks associated with real estate investment, including competition for tenants, interest rate risk, occupancy issues, insurance risks, inflation risk, among others.;

- Offering is not contingent on a minimum capital raise;

- Multiple conflicts of interest, including compensation arrangements, incentive fee structures, positions held with affiliated entities, co-ownership arrangements, and the purchase of and allocation of investment opportunities;

- COVID-19 could have a material impact on the Fund’s investments and operations.

For a more complete discussion of risk factors, view the in the Caliber Opportunistic Growth Fund III LLC PPM.

Invest in a diversified mix of assets with long-term growth prospects.

Contact us for further Information

Overview Sheet

Please enter your information below to access the overview sheet.

021-SKY-050223