Caliber The Wealth Development Company

Caliber is a leading financial services company in the alternative asset management space, focused on commercial real estate, providing financial professionals with well-structured alternatives to traditional investments.

Middle Market Fundraising & Capital Deployment

We invest in middle-market assets and geographies, applying established institutional private asset investment models, to deliver outsized returns.

Vertically Integrated Operating Model

Our investment service model produces improved visibility and control, enhanced investment returns, and robust off-market deal flow.

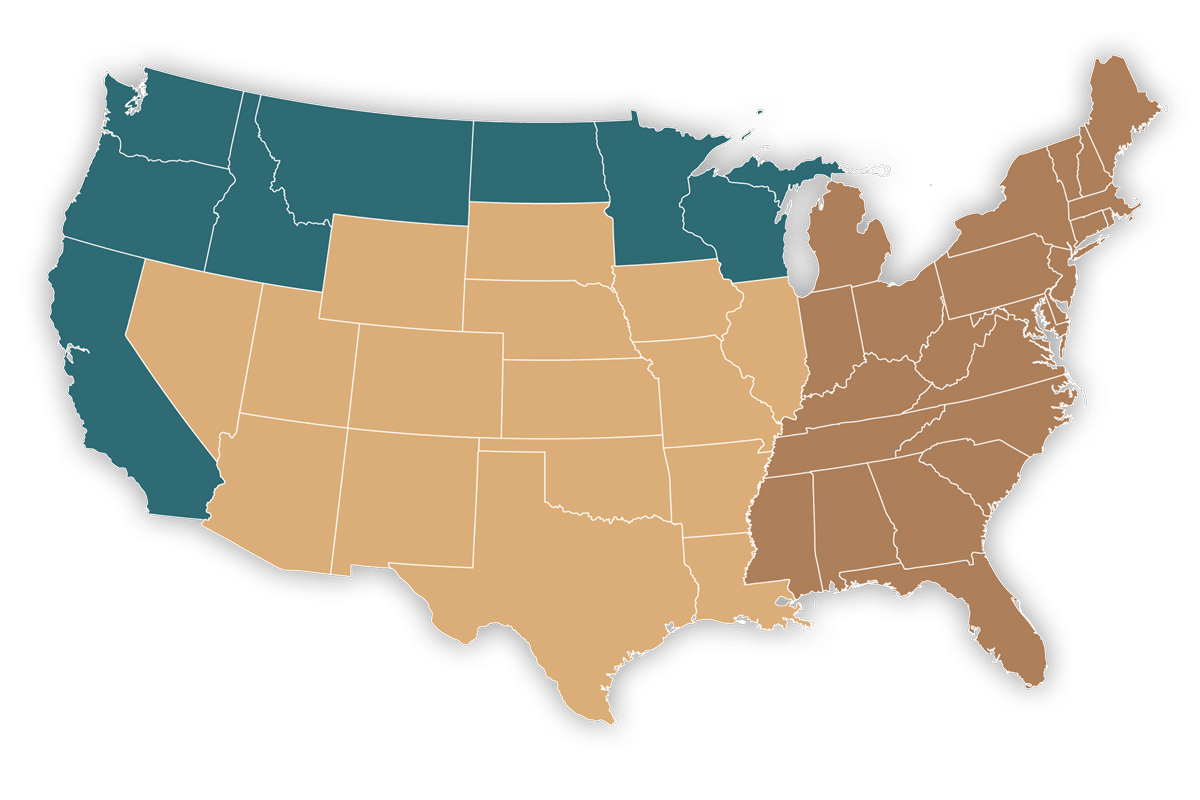

Growth Markets Geographic Focus

We focus on cities and regions with growing populations that are business friendly, with favorable taxes, entitlements, and access to local governments.

Caliber's Cycled Assets Track Record

As of October 22, 2022*

17.7% IRR

1.84x Deal Multiple

5 Years Average Hold Period

$71,752,270 Total Profit

Past performance is not indicative of future results. This track record is for informational purposes only and is not an offer to buy securities or interests in any investment. You may contact your Caliber representative for a copy of the detailed cycled assets track record.

Forged In Distress Born of the Financial Crisis

Caliber was founded in 2009, from the heart of the financial crisis, acquiring distressed assets.

We identified a unique advantage, in the underserved middle market. Our purpose-built investments are asset agnostic for the highest and best use, driving multiple avenues for growth with a cycle-tested team with deep industry experience and local relationships for proprietary off-market deal flow. As economics change we continue to seek out market appropriate solutions.

Caliber's Track Record

of Growth

2.5B+ Assets Under Managment & Assets Under Development*

$500M+ Equity Raised

14-year History of Operations Cycle Tested

018-SKY-050223